The US Dollar's Collapse Is Not If; But When..

We discuss the continuing decline of the US Dollar by successive governments – losing 98% of its value since 1970 – and what you can do to preserve your savings?

Picture is of a Zimbabwe 10 Trillion Dollar Note - before their hyperinflation became far worse)

Thomas Jefferson, in the late 1700s, warned that “paper money is liable to be abused, has been, is, and forever will be abused, in every country in which it is permitted”. Paper money may of course be backed by assets such as gold. Today the US Dollar is now merely printed pieces of paper backed by nothing more than peoples’ belief it is worth something. Half a century ago the US Dollar was however substantially backed by gold reserves. That is until August 1971 when President Nixon ‘temporarily’ took the Dollar off the ‘gold standard’. At that time the federal budget deficit was approximately $23.2 billion. Von Mises noted about government policy promises and abuse of paper money:

“… government always finds itself obliged to resort to inflationary measures when it cannot negotiate loans and dare not levy taxes, because it has reason to fear that it will forfeit approval of the policy it is following if it reveals too soon the financial and general economic consequences of that policy…”

Most informed commentators admit the dollar is not about to collapse; but are alarmed at the current US Government (ie taxpayer’s) debt levels along with continued currency printing. We will begin by reviewing the current fiscal state of the USA’s finances before defining what ‘money’ is. We will then discuss some details about the increasingly debt-ridden US economy. A final note will concern how to protect the value of your savings.

As of mid-July 2025 the US Government debt is $37 trillion; not including other unfunded liabilities such as social security which put the total at over $US 100 trillion. This debt forecast to grow to $45 trillion by 2029. In context each taxpayer in the US now ‘owes’ $250,000 due to successive governments’ reckless spending. There are only two solutions to this: printing more currency or defaulting. The most likely solution will be printing ever more currency with the accompanying erosion of citizens’ savings and purchasing power. Alan Greenspan famously (and cynically) said of pensions and social security payments in dollars: ‘We can guarantee cash, but we cannot guarantee purchasing power’. Inflation and its erosion of your savings is almost always the outcome of government currency printing to reduce their debts.

Hyperinflation and destruction of a Nation’s currency:

Most countries resort to printing currency and in the process they wipe out the savings of their citizens. This happened in Weimar Germany more than once when the government used the printing presses to meet its obligations.

A well-known story from this era was that a man pushing his pile of banknotes around in a wheelbarrow stopped to buy something from a shop. When he came out of the shop his pile of notes was left on the pavement after a thief stole the wheelbarrow. Here is a chart showing how the German Mark declined against gold as the government printed more and more currency. As can be seen from the chart most savings were wiped out before 1920 after the currency was debased tenfold. Less than three years later the currency had been debased another tenfold; before finally being totally debased to worthless paper a year later. The speed of the debasement is also noteworthy as all confidence in the government and the currency is lost.

Germany’s Hyperinflation : German Mark to 1 Oz of Gold 1914 to 1924

Most western currencies are ‘fiat’ and backed by nothing more than confidence in the government. However, continued deficit spending in many of these countries has eroded substantially the currency’s purchasing power. Alasdair Mcleod, a retired city banker and commentator at Schiffgold.com, noted the decline:

“It is now over 50 years since the dollar and all other currencies with it became entirely fiat. … there is growing evidence that the current dollar-based fiat currency episode, like all others before it, is coming to an end”

For context since Nixon’s 1971 announcement the US Dollar has lost 98% of its purchasing power. In other words a whole US Dollar now only purchases the equivalent of 2 cents worth of goods compared to 1970.

Definition of Money:

Money is anything that serves as a medium of exchange; ie it is accepted in exchange for a good or service that one wishes to purchase and also allows the seller to purchase a good or service with the same money. A consumer who wishes to purchase bread pays a sum of money to the baker; and in turn the baker may also use this money to later purchase potatoes from the farmer. Today money takes the form of coins or banknotes generally issued by governments; but has in the past also included amounts of gold, silver, copper, seashells, and even cigarettes.

Money has to have several key characteristics[i]. i) money is a medium of exchange. ii) it is a unit of account; ie it is divisible and measurable. iii) money is also a store of value; the baker may sell his day’s production of bread and take his day’s earnings home as savings for future purchases. Today many purchases are no longer made in notes and coins; but by debit or credit cards or direct bank account transfers.

Money also has a present and a future value. A dollar is generally worth more today than some date in the future. Receiving 100 dollars today would be worth more than receiving the same amount in a year. This concept is known as the ‘present value’ of money. Thus, lenders expect to receive a return, or ‘interest’, on any money they lend out to borrowers. Savers similarly expect a return on their savings in lieu of spending this money today.

Fiat currency:

Paper (or Fiat) money can be printed at will by governments; which is why high spending politicians are in favour of Fiat currencies. The successive US governments’ spending and deficit levels (not to mention funding their wars) has been enabled by a Fiat currency sytem. Many governments presiding over fiat currency systems have also engaged in deficit spending in the past; and the result has invariably been the destruction of the currency. As Voltaire noted in 1729: “paper money eventually returns to its intrinsic value … zero”.

When populations lose faith in their governments’ money they do not wish to hold it; and instead spend any money they receive as soon as they can on goods with current and/or future value. There are many recent and historical examples globally of government destruction of the nation’s currency through printing to repay excessive deficit spending; including Turkey, Zimbabwe, Venezuela, and inter-war Germany. Even the US government – who owns the global reserve currency - is engaging in such deficit spending that will inevitably result in the currency’s destruction as illustrated above discussing the German Mark.

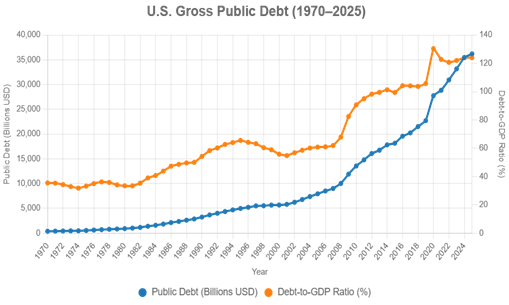

See the two charts below to illustrate the rapidly rising debt levels and expansion of the money supply resulting from deficit spending:

Figure 1: US government debt and debt to GDP ratio 1970 to 2025

Note how ‘debt’ is turning into a hockey stick that looks similar to the one in the chart above. Note also that this debt is over 120% of GDP. The IMF often uses 70% for advanced economies as an upper limit for ‘heightened risk’. Economists will not suggest there is a key percentage of debt-to-GDP that guarantees hyperinflation; however, ratios above 150% in developing economies (especially where there is political instability) often precedes a crisis. Of course this published ratio does not include all other unfunded liabilities that actually mean the US government total debt is greater than 200%. We must consider at what point does the US dollar lose its credibility? Below the second chart shows the growth in the money supply since 1970

Figure 2: Federal Reserve Graph of US Money Supply since 1970

As can be seen from the charts US government debt levels and the money supply have risen significantly since the 1970s – and very rapidly since 2008’s “QE” policy. Even more deficit spending is planned by the current administration which will further increase both government debt and the amount of money circulating in the economy; the resulting (and entirely predictable) price inflation, shortages, and price distortions, are making life very difficult for many people across the USA. It is also inevitable that the USA will at some point lose its reserve currency status.

As is well known: when governments turn to the printing presses to cover their debts and spending promises the inevitable result is rising prices. According to Von Mises:

“an increase in the quantity of money (in the broader sense of the term, so as to include fiduciary media as well), that is not offset by a corresponding increase in the need for money (again in the broader sense of the term), so that a fall in the objective exchange-value of money must occur”[i].

From his research Milton Friedman also concluded "Inflation is always and everywhere a monetary phenomenon”[ii] Like Von Mises he debunked the Keynesian assertions about inflation and instead concluded that: in the long run increased monetary growth, arising from government money printing, increases prices but does not increase economic output. The term given to increased prices and static or reduced output is ‘stagflation’; a term used in the 1970s and now increasingly being used to describe the current economic situation in western economies.

Economic theory aside; consumers experience this phenomenon when prices of everyday goods rise - and faster than any rises in their wage. As a recent example, this is happened in western economies as a result of increased government covid pandemic related spending combined with reduced output during the same period. This spending increase is continuing and even the ‘massaged’ government RPI/CPI (CPLie) statistics are showing the impact.

The USA is not the worst example though: higher inflation is being experienced in countries such as Zimbabwe (73%) Turkey (61%) and Argentina (44%) – although Argentina’s Austrian Economist President, Javier Milei, is successfully tackling the country’s economic woes[iii]. When experiencing high inflation, the population eventually realise that their wages and savings are becoming increasingly worthless and spend their money quickly – causing even higher inflation from scarcity of goods. Additionally when there is high inflation savings rates are often far below the inflation rate. For example, savings in Turkey could earn around 24%; which is a negative 11% when compared to the officially reported inflation rate of 35%.

People living under such economic conditions soon realise that their savings and wages are becoming increasingly worthless. Under these circumstances they spend their savings and wages on real goods and items as soon as they can. This further exacerbates the upward pressure on prices and creates a vicious circle of erosion in the currency value, product shortages, and accelerated government printing. The end result is collapse of the currency.

Government is usually to blame for loss of value in the currency:

What is the cause of the erosion of money’s purchasing value? In almost all circumstances the blame lies with government policy failure. As Rockwell Jr (2006) noted when discussing why governments move away from currency backed by assets (usually gold) to fiat currency:[iv]

“… the real reason that government destroyed the gold standard, and why our money has been completely untied from anything real and has been reduced to nothing more than computer entries backed by pressed cotton tickets with coloured printing of idealized government officials, has little to do with theoretical error. Government found it to be in its interest to create all the money it would ever need for itself. …

The power to inflate is absolutely crucial to the agenda of everyone who believes in using the government to manage the economy and society. As Mises says, they need the power to inflate in order to finance their policy of reckless spending, lavish subsidies, and bribing voters.”

When big government invariably results in massive policy failure the value of money and wages visibly diminish, and at increasing speed, in front of the population. Furthermore; savings rates are also invariably negative when compared to the speed of reduction in purchasing power of the currency. Such erosions in the ability to buy daily essentials, let alone protecting ones’ wealth, are a daily reminder to populations that their money no longer has value. In these circumstances real assets have value and ‘barter’ often returns to the economy; and printed pieces of paper masquerading as money become worthless.

So what to do to preserve wealth?

In circumstances such as these real assets, precious metals and jewellery, and debt (if it is serviceable) are useful.

· Owning real assets that do not depreciate excessively may preserve some value. If you bought a bicycle for $100 ten years ago and inflation is 10% per year after 10 years you might still be able to sell it for $100; but a new bicycle is likely to cost nearly $300.

· Owning precious metals such as gold and silver coins often preserves value. Review the chart of Weimar Germany. Anyone holding paper currency lost everything; but wise people holding gold ounces preserved their wealth. In fact denominated in US Dollars 1 Ounce of gold has increased in price from $36 to $3350 in Mid-July 2025 – around a 100X increase in value.

· A riskier strategy is to have debt. Many people in the UK in the early 1970s bought houses for an average of £5,000. If they took out 25 year mortgages on their houses by the time the mortgage was paid off the house price was an average of £51,000. In the same time the average UK wage increased from £1,200 to £16,000 per year. Thus for people with high debts currency debasement may be positive.

Overall however, the health and stability of the economy is likely to have overall negative consequences.

Conclusion:

The Russian Revolutionary Lenin was noted to say this about debasing a currency:

“the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens

… the process impoverishes many (and) actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security but [also] at confidence in the equity of the existing distribution of wealth.

… As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless…”

Whatever the intentions of governments were when printing ever more currency the outcome is invariably negative. Returning to Von Mises, and completing the quotation from the introduction, related to government currency printing to hide the realities of their policies:

“… since by misleading public opinion it makes possible the continued existence of a system of government that would have no hope of the consent of the people if the circumstances were clearly laid before them. That is the political function of inflation.

It explains why inflation (ie currency printing) has always been an important resource of policies of war and revolution and why we also find it in the service of socialism.”

Fiat currency therefore serves not citizens or hard working taxpayers; but instead it serves governments intent on stealing the value of savings from its citizens and waging war.

REFERENCES

[i] The Theory of Money and Credit. (p272)

[ii] Milton Friedman. Quoted in https://www.investopedia.com/terms/m/milton-friedman.asp Accessed 04/04/2022

[iii] Tradingeconomics.com

[iv] https://mises.org/library/what-government-doing-our-money Accessed 05/04/2022

[i] https://open.lib.umn.edu/principleseconomics/chapter/24-1-what-is-money/ Accessed 04/04/2022